Crypto Nation Switzerland has outstanding starting conditions for crypto and digital asset ventures, not only for fintechs, neo or non-banks. Traditional banks are also increasingly venturing

into the new terrain. On the one hand, the blockchain and crypto ecosystem that has been developed around Crypto Valley for years provides the necessary basis. More essential, especially for

traditional banks, is the clear set of rules created by the DLT Act, which provides a legally and regulatory reliable framework, one of the first globally.

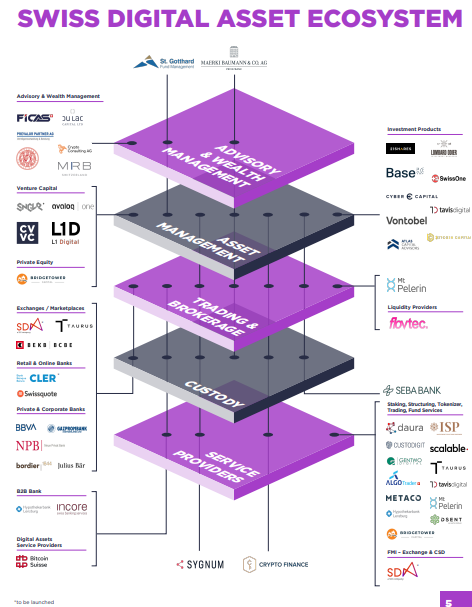

The diagram further down clearly shows which players are active in the Swiss digital asset ecosystem and have already ventured into the crypto future (source: First Swiss Digital Asset and Wealth Management Report 2021, published by CV VC AG).

At first glance, it is striking that the two major Swiss banks UBS and Credit Suisse are missing. Wouldn't one assume that the two big players in particular would take a first mover position in

view of the advantages just mentioned that are available on their doorstep, so to speak, in their home market with regard to crypto?

Well, first mover is perhaps a bit much to ask, given the still young and eventful crypto past, the high risks due to crypto price volatility, or the still predominantly unclear regulatory

handling of it worldwide, right at the forefront of the question of how the U.S., for example, will deal with it. Furthermore, the big players will probably want to take a little more time with

such a forward-looking decision, as they - in contrast to their national competitors - bear additional burdens as system-relevant banks (too big to fail / gone concern regulations), including the

associated capital requirements according to Basel III.

Nevertheless, one would gradually expect clearer signals. Currently, rather the opposite is the case. UBS expresses itself more than conservatively, as its CEO Hamers told Bloomberg on July 20

(more here): "We don't offer it actively [...] We feel that crypto itself is still an untested asset

category." This contrasts, for example, with the - still cautious - path taken by American competitors, e.g. Goldman Sachs: Goldman sees upcoming great value in it and indirectly even assigns

intrinsic value to crypto assets because of its network effects, placing it in the periphery of commodities (as Jeff Currie, Global Head of Commodities Research does). And Mathew McDermott,

Global Head of Digital Assets with Goldman explains the anew engagement of the bank in crypto in two words: Client demand (see GS Top of Mind -

Crypto: A new asset class?). Credit Suisse, on the other hand, has so far hardly made itself heard on its position regarding crypto or digital assets, apart from an internal memo from March

2021, which is attributed to the bank and in which Bitcoin in particular is even seen - positively - as a hedge against central bank money in the long term due to its quantitative limitation

(more here). Credit Suisse, however, is currently struggling with the aftermath of the gigantic wounds torn by Greensill

and Archegos, and is therefore wary of thinking too prominently in the direction of crypto, let alone taking bold steps.

Let's take a closer look at the Swiss Digital Asset Ecosystem and the underlying report mentioned above and what can be gleaned about the incumbent banks from it.

In addition to the absence of the two major Swiss banks, it is noticeable that so far one traditional private bank in particular has dedicated itself to all service areas of the crypto and

digital asset value chain: Märki Baumann & Co. AG - "Chapeau" is all that can be said. The private bank is the only bank to also occupy the Advisory & Wealth Management area for digital

assets, which can virtually be described as the wealth management supreme discipline. It is remarkable that a bank today already has a professional opinion on digital assets in order to provide

its clientele with appropriate advice.

Moreover, the Advisory & Wealth Management service field remains orphaned by traditional banks. So far, incumbents have only ventured into the field in the crypto business areas of custody

and trading/brokerage - but at least they have done so - to a certain extent as an ideal entry point: the risks here are manageable from a bank's point of view. Brokerage is basically execution

only, i.e. trading on the instructions of and for the account of the customer - the risk lies with the customer. Crypto asset custody can even be described as an almost typical entry service. One

could say custody is like what banks used to do with gold and other assets for from the origin.

Various traditional Swiss banks are already active in this field, such as BEKB as a crypto exchange (despite its name, it does not hold a state guarantee), retail banks or online brokers such as

Bank Cler and Swissquote, or Bank Julius Baer in the private banking segment. It is to be expected that other smaller or medium-sized Swiss banks will follow, possibly also using their existing

banking systems that have been expanded for crypto, such as Avaloq.

It is also worth mentioning, however, that foreign private and corporate banks are trying to establish themselves in the crypto business on the Swiss market. In doing so, they are taking

advantage of the undoubtedly existing customer demand and the legal space created by the Swiss DLT Act, which is solid in legal and regulatory terms. Spain's BBVA, Russia's Gazprombank or

Jordan's Arab Bank are worth mentioning here. They are betting on crypto as a new asset class and are quite obviously already testing out the new business field in the Swiss market.

Finally, mention should also be made of the (digital) asset management business area and Bank Vontobel, which is active in this area issuing its own crypto-related products.

Vontobel as well as Bank Julius Baer should be specifically mentioned here. Both traditional banks are internationally active larger banks that have already established themselves in the Swiss

crypto ecosystem at an early stage. They can rightfully be called the Swiss first mover incumbent banks.

Back to the two major Swiss banks and what we can expect from them in the foreseeable future, especially: when will they move?

It's not that in the case of UBS, for example, crypto and blockchain are not an issue - on the contrary. According to a recent Blockdata

report, UBS is top listed among the biggest investors into the Blockchain / Crypto-field. The bank ranks #4 with an estimated investment amount of USD 279M so far and right behind English

Standard Chartered and the two U.S. Banks, BNY Mellon and Citibank. The top 13 list features more or less the who is who of the global wealth managers and investment banks, with Barclays marking

its bottom and - somewhat behind - an estimated investment volume of USD 12M. As seen above, the bank still sees crypto investments as too risky to offer corresponding services to its clients.

However, it is questionable how long they can continue to do so, or rather, how long it can afford to take this stance towards its customers. In view of the positioning of various major banks

abroad, it is appropriate to assume that UBS will also soon do a backward roll in order to meet the demand of their clients. In view of the efforts already invested, they seems to be prepared for

this step.

And indeed, according to a LinkedIn note by Alexander E. Brunner, one of the co-authors of the CV VC report, UBS Asset Management has a digital asset team (that is in the open)! (more here). This can be considered as a first still silent

but very concrete step into the crypto future of the bank. Rather bold moves will though be expected at a later state, presumably once that also the U.S. will have a consistent crypto regulation

in place, which can still take a while.

At Credit Suisse the case is a bit different. Next to what has been described at the beginning already, it is noteworthy to add that the FINMA (Swiss financial market regulator) is currently in

the house to investigate into the Archegos and Greensill cases, and trigger related enforcement procedures. Increased scrutiny can therefore be expected especially with regard to crypto ventures

of the bank. An indirect indication of still insufficient engagement with crypto can also be gleaned from the aforementioned Blockdata report. The bank does not appear among the first 13 players,

indicating that its investments so far and at best sum up to below $12M. Within that range known pilots like blockchain-based trade settlement to accelerate related processes of the bank and

reduce cost would perfectly fit.

Credit Suisse has not shown a convincing course in recent years as to how it wants to and can position itself in the global market (the CS share price was recently below CHF 9 at times,

reflecting the level of investor's trust into). However, with the new strategic leadership around António Horta-Osório, who is increasingly focusing on banking and risk expertise again, and has

already set corresponding signs, a solid strategy can be expected through Q4/2021, which will not be able to avoid tackling the topic of crypto and digital assets.

We can therefore state that UBS is about to gear up for the crypto market and Credit Suisse - at a lower scale and pace - will follow suit.

Exiting times, more to come, stay tuned

Write a comment