22. May 2023

Crypto - pure scam and speculation or fundamental / intrinsic value attributable to it? - Crypto is "crazy, stupid, gambling, ... And people who oppose my position are idiots..." sic Charlie Munger in 2023.

In this article you learn how to distinguish crypto-scam from crypto-value, which cryptoassets and crypto tokens may carry intrinsic value and how it can be measured using fundamental value analysis methods adopted to the new world.

05. November 2021

This year's Christmas Day is the earliest possible formal date for the SEC to approve the first Bitcoin SPOT ETF.

Grayscale Investment CEO, Michael Sonnenheim is confident that his application to convert the flagship product Grayscale Bitcoin Trust (OTCQX: GBTC) into a Bitcoin Spot ETF will be approved by the SEC. He derives this from the agency's recent approval of various bitcoin futures ETFs.

That would indeed be a watershed moment for the entire Crypto space, if there were not the SEC ...

23. October 2021

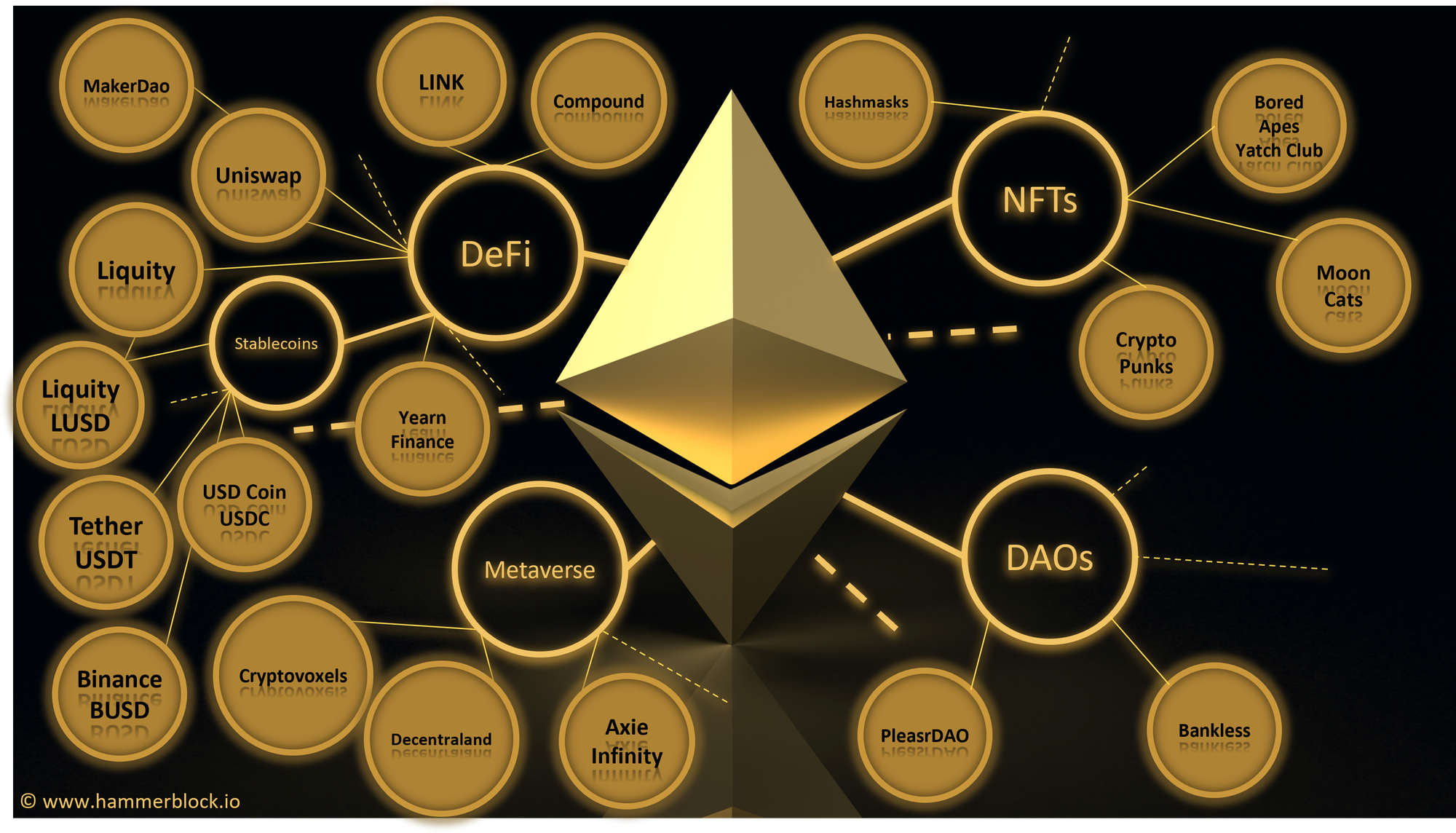

General purpose blockchains like Ethereum are more than Bitcoin as a single purpose Blockchain. The underlying network with its literally unlimited use cases generates higher value to the real world ... and longer term that will also be reflected in the valuation of the coin, despite, price correlation between BTC and ETH is still high, currently. In this article on MoreThanDigital, I will highlight the similarities and differences between the two networks and what Ethereum’s additional...

18. September 2021

Switzerland offers excellent framework conditions and ecosystems in the blockchain and crypto sector, deserves international recognition as a hub and avant-garde (see more in a previous article). One would think that everything is in place to attract crypto companies, especially startups, if it weren't for the fact that blockchain founders simply can't find banks within the country's borders to open a business account, on which every company ultimately depends. Focal point of the problem lies...

11. September 2021

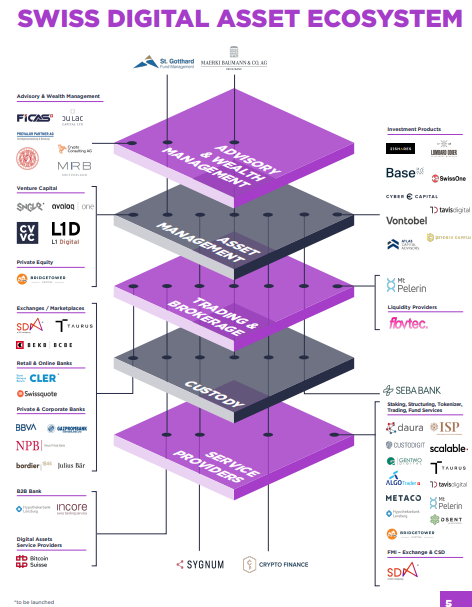

Crypto Nation Switzerland has outstanding starting conditions for crypto and digital asset ventures, not only for fintechs, neo or non-banks. Traditional banks are also increasingly venturing into the new terrain. On the one hand, the blockchain and crypto ecosystem that has been developed around Crypto Valley for years provides the necessary basis. More essential, especially for traditional banks, is the clear set of rules created by the DLT Act, which provides a legally and regulatory...

20. June 2021

In letzter Zeit lassen sich vermehrt Beispiele beobachten, in denen sich traditionelle Banken mit Krypto-Angeboten positionieren, und entsprechend exponieren. Sie tun dies obwohl sie über schlechtere Startbedingungen wie der Schweizer Bankenplatz verfügt.

Was ist los mit unserem traditionellem Swiss Banking?

Dieser Artikel ist ein Plädoyer für einen starken und soliden Schweizer Bankenplatz und zeigt auf, wo Opportunitäten liegen und weshalb nun Handeln angezeigt wäre.

26. May 2021

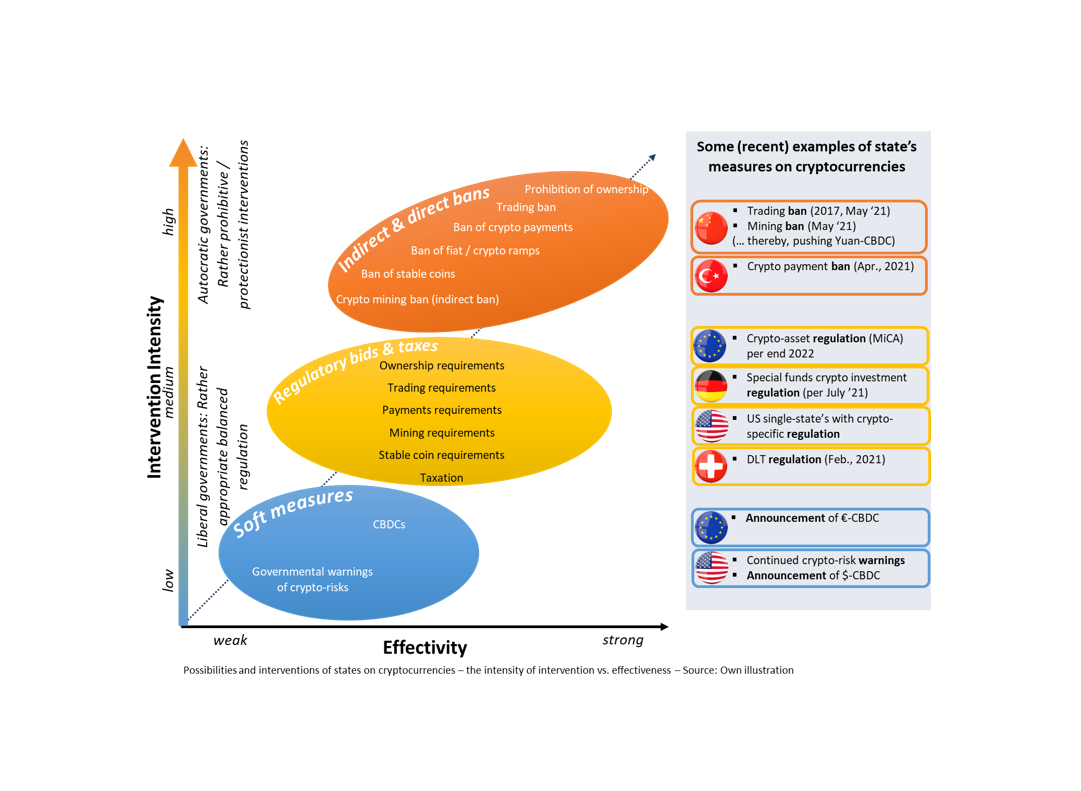

China has triggered a massive Bitcoin and altcoin crash last week by re-iterating its trading ban and issuing a new country-wide mining ban.

But what is next at the crypto-regulation horizon?

States around the world have recently taken a high dynamic of measures to regain control over the crypto world, sometimes even in a panic-like manner.

The NEXT BIG HIT to the crypto-market will be triggered by US regulation, once the U.S. government has made their stance

04. April 2021

This is part 1/3 by Markus Hammer about a digital Franc for Switzerland. It describes why states and their central banks are currently pushing their CBDC (Central Bank Digital Currency) with great momentum, the relation to private cryptocurrencies like Bitcoin and why the latter are not like money.

This part 1 is about cryptocurrency, state money vs private money, account-based vs value-based money, Bitcoin, DLT, Blockchain, stablecoins, Diem

Contact / Social Media

www.hammerblock.io powered by HammerExecution

Email: markus.hammer@hammerexecution.com

LinkedIn: https://www.linkedin.com/in/hammerblock/

reddit: u/hammerblockio

twitter: @hammerblockio