18. February 2023

Why is the SEC hitting PoS staking... or is it not doing that at all? Opinions actually vary, from once-off action, not to further worry, to continued boiling the water with unknowing destination - Amongst the expert opinions also my personal view on the matter

07. May 2022

n March the Axie Infinity Ronin bridge was hacked and $625 million stolen, supposedly by North-Korean cyber criminals. What is special of the crypto-hack this time? Its scale, one of the biggest in history, its malicious actors, a Nation-backed criminal cyber group (Lazarus), and particularly its novel means of enforcement. In this short article, I provide the details behind and conclude, how effective crypto addresses on a sanctions list are to prevent money laundering in the DeFi space.

05. November 2021

This year's Christmas Day is the earliest possible formal date for the SEC to approve the first Bitcoin SPOT ETF.

Grayscale Investment CEO, Michael Sonnenheim is confident that his application to convert the flagship product Grayscale Bitcoin Trust (OTCQX: GBTC) into a Bitcoin Spot ETF will be approved by the SEC. He derives this from the agency's recent approval of various bitcoin futures ETFs.

That would indeed be a watershed moment for the entire Crypto space, if there were not the SEC ...

24. October 2021

Markus Hammer's and other market experts' views on the first Bitcoin Futures ETF issuance in the U.S. (i.e. the ProShares Bitcoin Strategy ETF (BITO)) - in an article of Andrew Singer in Cointelegraph

20. June 2021

In letzter Zeit lassen sich vermehrt Beispiele beobachten, in denen sich traditionelle Banken mit Krypto-Angeboten positionieren, und entsprechend exponieren. Sie tun dies obwohl sie über schlechtere Startbedingungen wie der Schweizer Bankenplatz verfügt.

Was ist los mit unserem traditionellem Swiss Banking?

Dieser Artikel ist ein Plädoyer für einen starken und soliden Schweizer Bankenplatz und zeigt auf, wo Opportunitäten liegen und weshalb nun Handeln angezeigt wäre.

26. May 2021

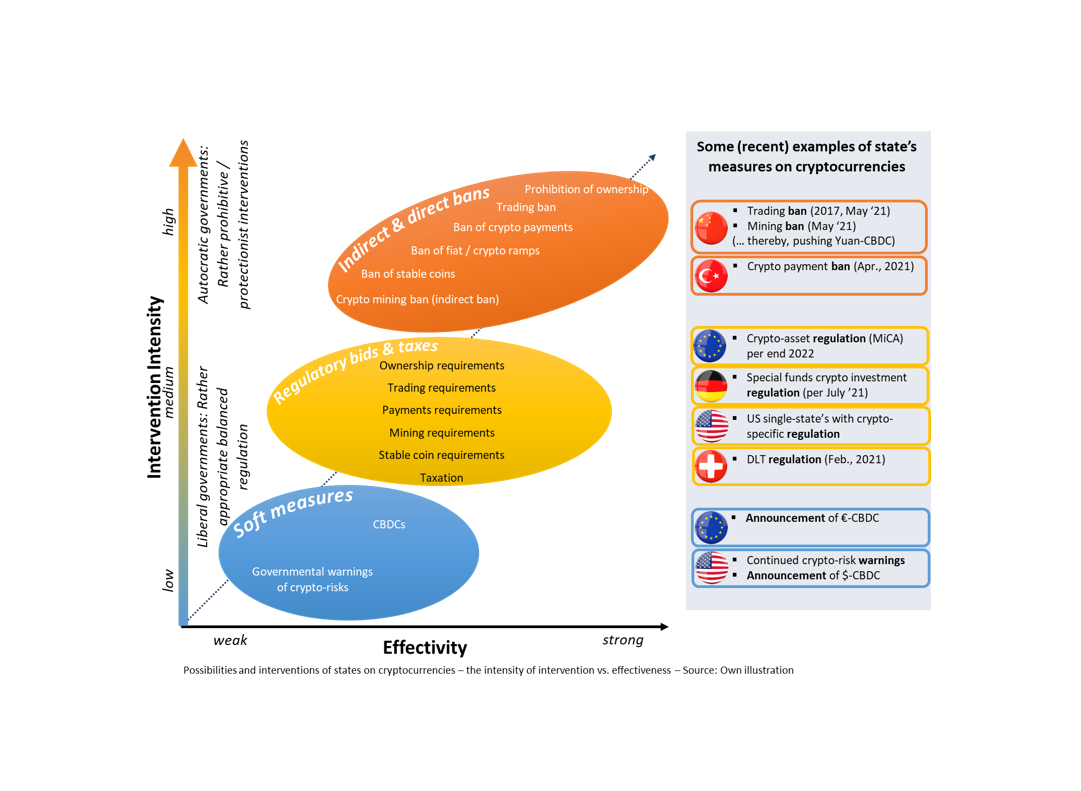

China has triggered a massive Bitcoin and altcoin crash last week by re-iterating its trading ban and issuing a new country-wide mining ban.

But what is next at the crypto-regulation horizon?

States around the world have recently taken a high dynamic of measures to regain control over the crypto world, sometimes even in a panic-like manner.

The NEXT BIG HIT to the crypto-market will be triggered by US regulation, once the U.S. government has made their stance

Contact / Social Media

www.hammerblock.io powered by HammerExecution

Email: markus.hammer@hammerexecution.com

LinkedIn: https://www.linkedin.com/in/hammerblock/

reddit: u/hammerblockio

twitter: @hammerblockio