09. February 2022

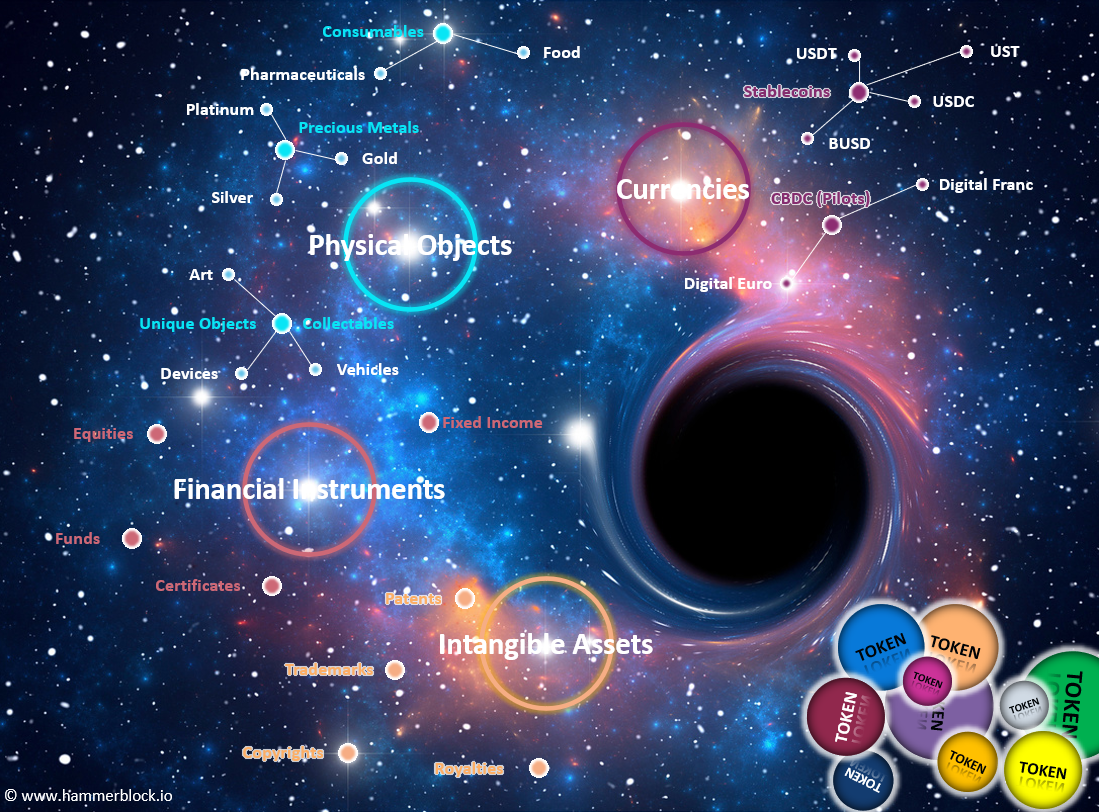

Tokenization allows virtually any real-world asset to be represented on the Blockchain. By 2027, according to a WEF estimate, 10% of global GDP will be stored on the Blockchain, around USD 9.38 trillion. The central building block for the emergence of a token economy is tokenization. This article describes what it is all about and its partly disruptive significance.

23. October 2021

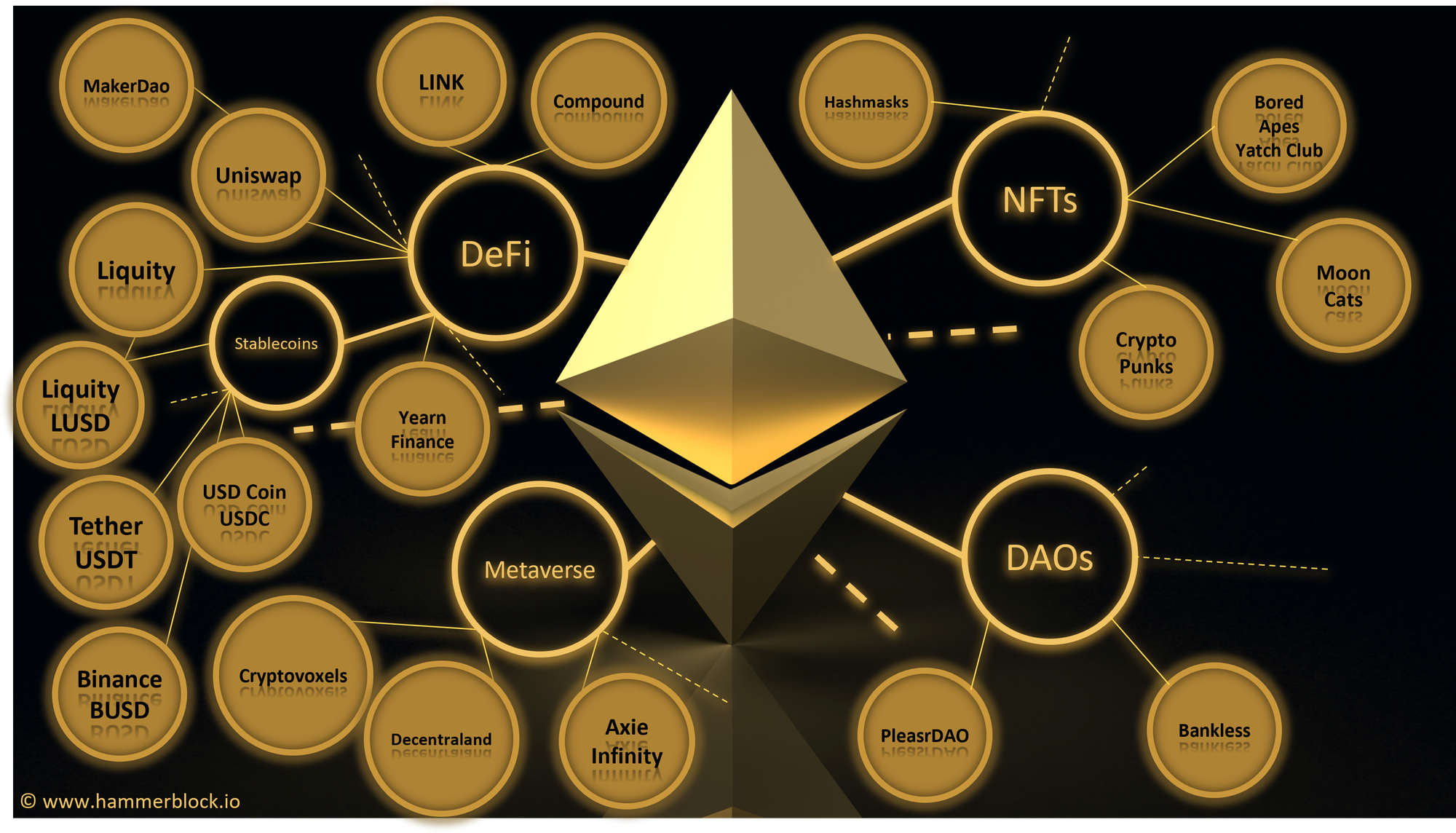

General purpose blockchains like Ethereum are more than Bitcoin as a single purpose Blockchain. The underlying network with its literally unlimited use cases generates higher value to the real world ... and longer term that will also be reflected in the valuation of the coin, despite, price correlation between BTC and ETH is still high, currently. In this article on MoreThanDigital, I will highlight the similarities and differences between the two networks and what Ethereum’s additional...

18. September 2021

Switzerland offers excellent framework conditions and ecosystems in the blockchain and crypto sector, deserves international recognition as a hub and avant-garde (see more in a previous article). One would think that everything is in place to attract crypto companies, especially startups, if it weren't for the fact that blockchain founders simply can't find banks within the country's borders to open a business account, on which every company ultimately depends. Focal point of the problem lies...

20. June 2021

In letzter Zeit lassen sich vermehrt Beispiele beobachten, in denen sich traditionelle Banken mit Krypto-Angeboten positionieren, und entsprechend exponieren. Sie tun dies obwohl sie über schlechtere Startbedingungen wie der Schweizer Bankenplatz verfügt.

Was ist los mit unserem traditionellem Swiss Banking?

Dieser Artikel ist ein Plädoyer für einen starken und soliden Schweizer Bankenplatz und zeigt auf, wo Opportunitäten liegen und weshalb nun Handeln angezeigt wäre.

26. May 2021

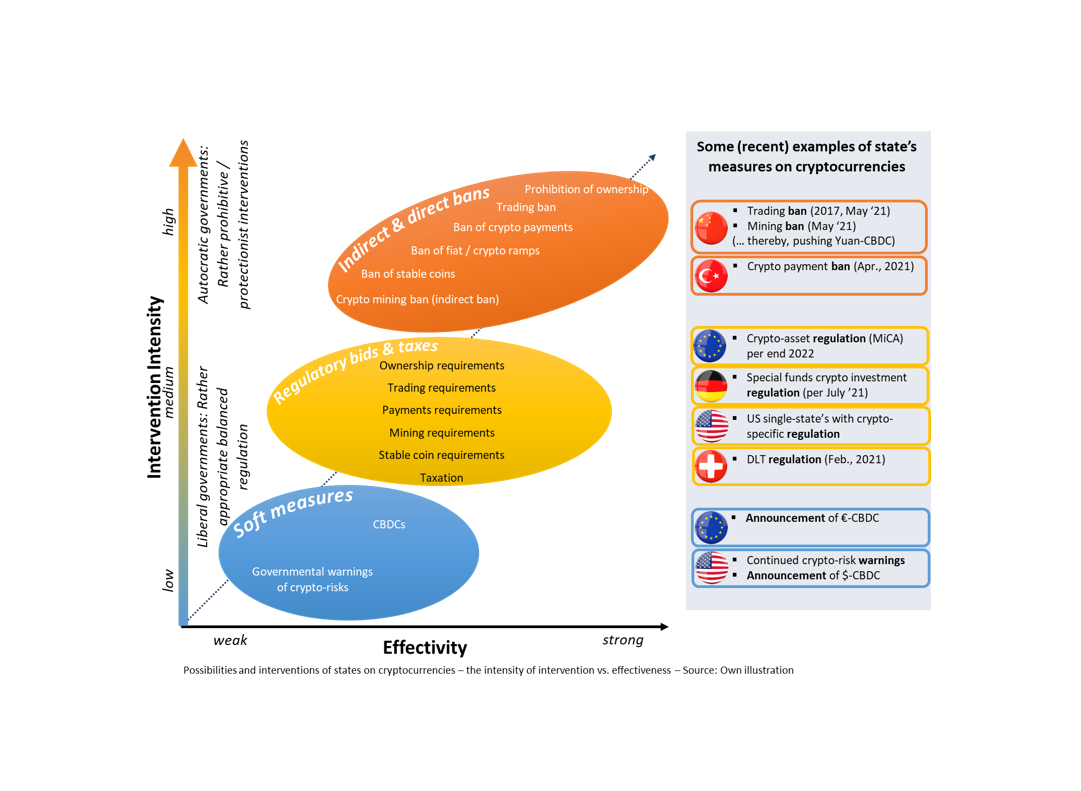

China has triggered a massive Bitcoin and altcoin crash last week by re-iterating its trading ban and issuing a new country-wide mining ban.

But what is next at the crypto-regulation horizon?

States around the world have recently taken a high dynamic of measures to regain control over the crypto world, sometimes even in a panic-like manner.

The NEXT BIG HIT to the crypto-market will be triggered by US regulation, once the U.S. government has made their stance

09. April 2021

This is part 3/3 by Markus Hammer about a digital Franc for Switzerland. Part 3 explains what the SNB design for a Swiss e-Franc, its benefits or threads would be, and is about: e-Frank, Swiss token, Swiss e-coin, physical cash, bearer instrument, transaction privacy, privacy protection, digital signature, blind signature, anonymous token, FLOSS, 2-tier architecture, PPP, cryptography, public vs private key

19. December 2018

#DigitalSwitzerland is taking another stance for establishing itself internationally as a hub for digital technologies and business models laying out a legal framework for Decentralized Ledger (DLT) and Blockchain Technologies. Swiss Federal Council adopted a report December 2018 reflecting the work of a finance and fintech expert group. The scope of this fundamental paper is cross-industry and thereby goes beyond the predominantly affected finance sector and its already widely known digital...

27. November 2018

U.S. Commodity Futures Trading Commission (CFTC) issues a primer through its LabCFTC on Smart Contracts and thereby makes clear that also 'digitized and coded' (Commodities) derivatives (contracts) are subject to existing regulation.

Contact / Social Media

www.hammerblock.io powered by HammerExecution

Email: markus.hammer@hammerexecution.com

LinkedIn: https://www.linkedin.com/in/hammerblock/

reddit: u/hammerblockio

twitter: @hammerblockio